My road to financial freedom ♥

August 25, 2018 |

| Google Image |

One of my all-time favorite when it comes to new year's resolution (the other one is to lose weight) is to S-A-V-E. This year, it is still in my list so let me share to you the things that I currently do to achieve my goal this time.

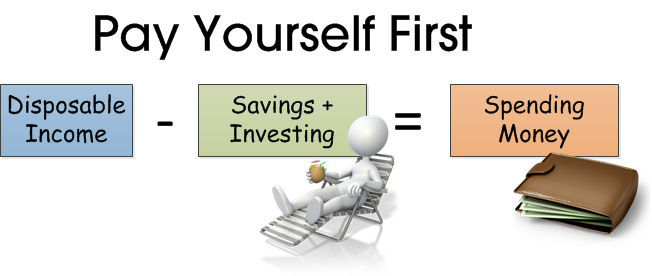

👉 Follow the "Income less Savings=Expenses" rule.

|

| Google Image |

It is said that "It's not how much money you make, it's how much money you save." Another realization for me is that I should develop the discipline to save first before spending. Before, when it is the vice versa (i.e. I just save whatever remains from the income after spending), I always end up with zero savings. Now, I always make it a point to allot 15% of my take home pay for savings which comprises of the following:

- Emergency Fund

- Retirement Fund

- Educational Fund for my son

- VUL

- Other Savings (HDMF-MP2, Coop)

Once I know my budget that I can disburse, that's the time I will set classify my expenses and allot budgets for each of them. Our usual expenditures are the following:

- Food/Groceries

- Utilities (cable, water, electricity, cellphone load)

- Transportation

- Matti's expenses (vaccine, supplies, etc.)

- Me Time fund (movies, going to the salon, etc.)

I also have another major expense which is for the monthly amortization for the house but I set this up as an auto transfer to my checking account.

In setting up the amount to be allotted per category, I based it according to my average monthly expenditures which I got when I tracked my expenses.

To be able to stick my budget, I use the envelope system. In this way, I can easily see exactly how much money have left per budget category by just taking a quick peek in my envelope.

|

| My money envelope |

👉Track my expenses throughout the day (up to the last cent).

Setting your budget is easy but without tracking your expenses will make it difficult. It is said to be one of the key factors in making your budget work for you. I realized that this will help me become more aware of what am I spending and where am I spending it. With this, I will know the areas (expenditures) where can I adjust.

Setting your budget is easy but without tracking your expenses will make it difficult. It is said to be one of the key factors in making your budget work for you. I realized that this will help me become more aware of what am I spending and where am I spending it. With this, I will know the areas (expenditures) where can I adjust.

There are several ways to do this. You can choose from: manual (by jotting down in a notepad) or electronic (by Using Microsoft Excel or mobile/desktop applications). I currently use "MyWallet" mobile app since it is easier for me to update it since my phone is always with me. It looks like this:

|

| It has the following features: [1.] Balance tracker, [2.]Expense tracker, [3.] Budget tracker, [4.] Bills and Receipts Tracker and [5.] Report Generation |

👉 Start building Emergency Fund.

| Google Image |

According to Investopedia, Emergency fund is an account for funds set aside in case of the event a personal financial dilemma, such as the loss of a job, debilitating illness or a major repair to your home. The purpose of the fund is to improve financial security by creating a safety net of funds that can be used to meet emergency expenses as well as to reduce the need to withdraw from high interest debt options.

Most financial planners suggest that we should have at least set aside 3 to 6 months worth of living expenses that should be highly liquid and are readily available when needed.

I just started building mine this year and I still have a long way to go before I complete my 6-month goal. I opened a separate account for this so that I will not be tempted to withdraw it if I see it in my payroll account.

I know I still have a lot more to improve on when it comes to saving but I am happy that at least I already started doing it. The big question is, hanggang kelan kaya to?😜

2 comments

Hi. Where did you buy your money envelope?

ReplyDeletehi!. via shopee po.

Delete